[email_link]

Coffee and Stickers

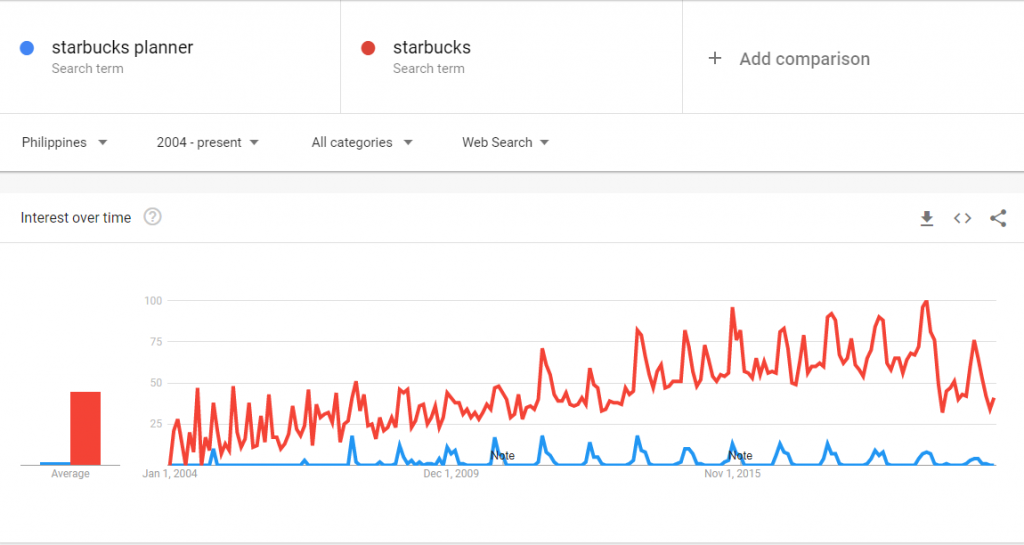

In December of every year, I double my sugar and caffeine intake. No, it is not because of mounting end-of-year pressures at work nor is it because of holiday cheer – it is because of the most popular loyalty promo that I am aware of locally: Starbucks Annual Planners. These planners have been an annual tradition for young urban professionals in the city and have been mine for the last 10 years (except 2020 for obvious reasons). There is an annual black market for them.

Globally, Starbucks is known to be a leader in rewards, loyalty, and data, which makes it no surprise that they attribute 40% of their sales to the Starbucks Reward Loyalty Program. While this is only one example of a brand leveraging modern Customer Relationship Marketing (CRM), not many are able to crack the code locally, especially for the biggest brands in our shores: Fast Moving Consumer Goods (FMCG) or Consumer Packaged Goods (CPG).

CRM has traditionally been a good fit for high-value, long-cycle services and products. Its cost to implement (and operate) usually necessitate considerable investments on both technology and manpower, in which only brands that have a command of wide margins per customer can justify investing in. In addition, traditional CRM has always been a very labor-intensive activity, where customers expect servicing by actual human beings who will bend over backwards to retain your customer business. It is no wonder that most brands, after seeing the price of admission shy away and stick to the familiar what has always worked.

Given these barriers to entry, we pose the question: Can FMCG brands invest in their own CRM programs?

(Marketing) Technology to Scale CRM’s Barriers

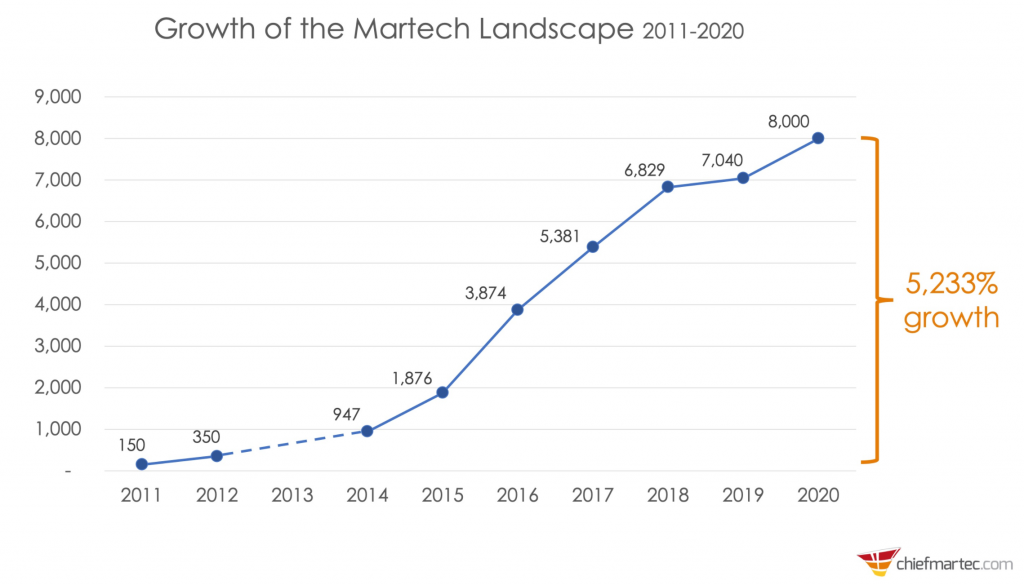

Marketing technology (Martech) has progressed significantly in the last 15 years. So much so that we are faced with thousands of providers offer many versions of essentially the same thing. Salesforce, SAP, and Oracle have always led the pack in terms of market share, but a myriad of Cloud Software-as-a-Service (SaaS) companies are challenging the big, monolithic implementations of the pack leaders in terms of value. Hubspot, Zoho, ActiveCampaign, and GetResponse (to name a few) entering the space has been a boon to the industry by leveling the playing field with more cost-effective offerings to choose from.

Marketing Technology providers have grown rapidly in the last 10 years.

The rapid growth of Martech providers indicate the ongoing “gold rush” of offering solutions and automations that augment the marketing operations for virtually any ability a brand may need in engineering its intended experiences for its customers. Martech solutions have been a key force in enabling scalefor customer experience and CRM, opening possibilities for brands to translate their core propositions to wider audiences. This enabled scale now makes CRM usable with large customer bases, (as in the case of FMCG brands)by automating many facets of the digital relationship between the brand and customer.

Optimizing Mindset for CRM in FMCG

While marketing technology opens the door for FMCG brands to seriously consider CRM programs, window-shopping is not quite the ideal starting point to planning it out. Diving headlong into the world of what the Martech space offers can easily lead to short-sighted program planning and getting distracted with the shiniest baubles. We propose for your consideration a short list of important concepts and mindset changes that are best given attention on the onset.

Modern CRM has scalability in its operational core – and is a key ingredient for FMCG CRM to work. Thinking with scale requires us to accept a reality when dealing with large customer databases: we simply cannot please everyone. In large-base CRM programs, experience design and decisions need to be assessed on how it will affect large swaths of customers, usually in the form of segments that will be treated differently. The value of data and analytics become critical in managing such programs; only with up-to-date quantitative analytics can we ensure reliable and informed decision making. The main mindset change here is instead of thinking of individual customer satisfaction, performance focus will need to shift towards metrics and KPIs – which will need to be defined and aligned carefully between teams.

You cannot escape the math: it is now more important than ever. Given the shift to scalability and the importance of data, it will be necessary to coax data and analytics experts out of the backrooms and into the rooms where actual decisions are made. These experts will be critical in guiding strategy and decision making, by turning data into meaningful insight. Some probability theory (“these may happen”) also comes to the fore, which will push out deterministic (“these will happen”) thinking and assumptions. Virtually every decision to be made will need to be grounded on predictions, carefully organized into testable hypotheses that will form a new corpus of knowledge for the brand’s marketing strategy for wide-reaching FMCG CRM campaigns.

Not everything needs to be automated with fancy AI machines – it should still start with sound strategy. Martech providers will always have a fancy and flashy proposition designed to draw attention to their “unique” AI capabilities (they are often hype) and their “all-in-one” platforms (features are often half-baked). The danger with falling in love with these offerings is that it tends to put their product/solution first, and the brand’s CRM needs (and strategy) second. Now, on the flipside, the beauty of the rich Martech space is that the many available options will allow a brand to be true to its core proposition (and values), translated into a viable digital FMCG CRM experience. And finally…

While scalability necessitates distancing from labor intensive hands-on servicing, anecdotal customer experience still provides valuable insight. Dipstick studies, satisfaction surveys, and ‘field reports’ from customer service (to name a few) are very valuable sources of insights that can provide a complete picture with the analytics. Remember that feedback does not need to come from all customers – this would be prohibitively difficult for FMCG brands. An always-on sampled study mixed with key complaints (and appreciation) from the contact centers should be a good start. While quantitative measurements form CRM program KPIs, we need this qualitative information to make sure that the program being designed for are actually for humans.

You do not have to should not start from scratch

A better way to look at Modern CRM (not just for FMCG brands, mind you) is that it is about orchestrating relationship efforts into one cohesive digital experience that will allow customers to start – and be invested in your brand. Modern CRM with its ability to scale is the instrument that applies at the very least what the brand already means for its customers. Translating the core brand experience should be the first step – and only after that (with all the learnings it will entail) should the brand explore the flashier side of Modern CRM.□